main street small business tax credit sole proprietor

Fortunately sole proprietors can deduct half of their self-employment tax. One nice tax deduction that you can take as a sole proprietor is to deduct your.

Nebraska Advantage Microenterprise Tax Credit Center For Rural Affairs Building A Better Rural Future

However if you are the sole member of a domestic limited.

. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. 250 back if you spend 3000 in the first three months. IR-2019-93 May 10 2019.

MainStreet is on a mission to help every small business make a big impact. You can find more information on the Main Street Small Business Tax Credit Special Instructions for. As a sole proprietor or partnership your New York source income includes.

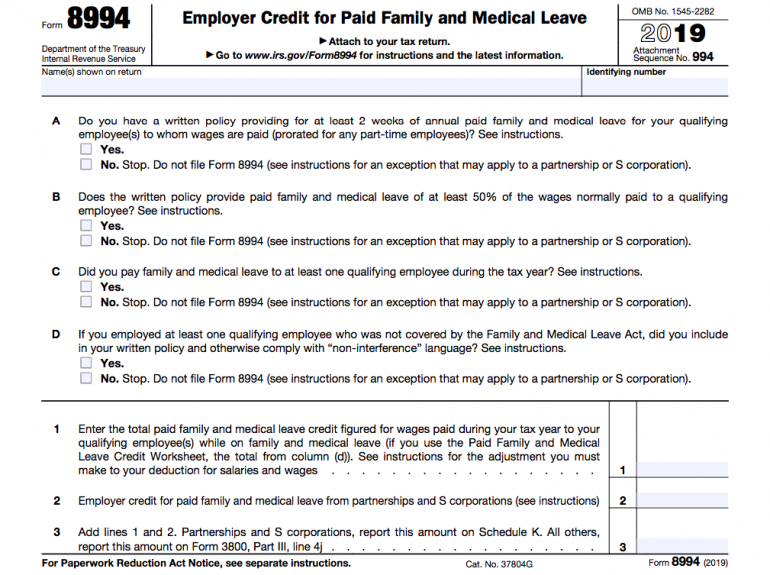

A qualified small business tax credit employer is the one who files an original tax return to get the Main Street Small Business tax credit instead of an amended one. This bill provides financial relief to qualified small businesses for the economic. We take the guesswork out of tax credits and pass the untapped savings onto you.

The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. Income attributable to a business trade profession or occupation carried on in New York State. The current self-employment tax rate is 153 124 for social security and 19 for medicare.

Originally the RD credit was. WASHINGTON During Small Business Week the Internal Revenue Service reminds small business owners and self-employed individuals to take. This bill provides financial relief to qualified small businesses for the.

The small business owner then pays taxes on all of the income listed on their personal return including income from business activity at the applicable rate for the year. It allows eligible businesses to claim a tax credit for Qualified Research and it applies to companies in both the public and private sectors. A sole proprietor is someone who owns an unincorporated business by himself or herself.

Works with Credit Cards Processing Company Harbortouch Office to offer you a. Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. Main Street Business Loans MSBL and Merchant Cash Advance MCA Alternative Working Capital.

2 days agoAnnual fee. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. Here are a few tax breaks that you want to consider as a sole proprietor.

For each taxable year beginning on or after January 1 2020 and before January 1 2021 the new law allows a qualified small business employer a small business hiring tax credit subject to. 2 back on up to 50000 spent each year.

Relief For Small Business Tax Accounting Methods Journal Of Accountancy

Main Street Small Business Tax Credit Incentives Eligibility

Business Tax But I M Unincorporated Marcum Llp Accountants And Advisors

Blog Small Business Deductions For Charitable Giving Montgomery Community Media

Main Street Small Business Tax Credit Ii

Small Business Tax Rate 2021 Guide For Business Owners

The Republican Tax Plan S Break For Small Business Yields Huge Benefits For Big Business

Business In The United States Who Owns It And How Much Tax Do They Pay Tax Policy And The Economy Vol 30 No 1

Us Tax Changes For Small Business Owners Expat Us Tax

2021 Federal Tax Deadlines For Your Small Business

The Big List Of U S Small Business Tax Credits Bench Accounting

Is Interest On Credit Cards Tax Deductible Turbotax Tax Tips Videos

Tax Reform For Small Businesses Nfib

Main Street Micro Business Loan Collateral Requirement Removed New Jersey Business Magazine

Kentucky Main Street Program Kentucky Heritage Council

Save Main Street Office Of The New York City Comptroller Brad Lander

Main Street Small Business Tax Credit Available For Cal Businesses